History for "Deposit Reconciliation"

-

Updated by Megan Pastor, Jul 25, 2023 at 7:37am

APPLIES TO: Coworking, WorkplaceUsing this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

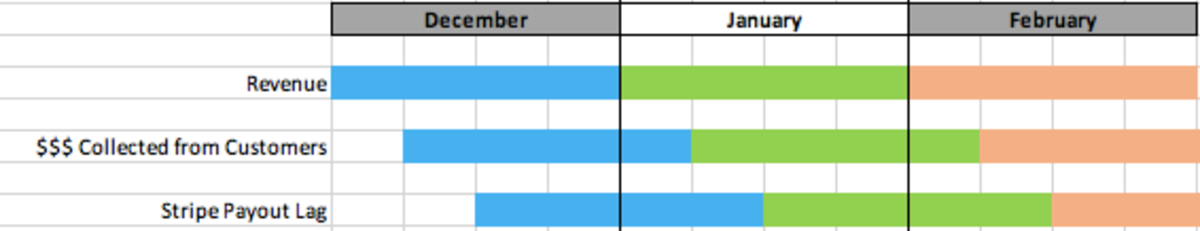

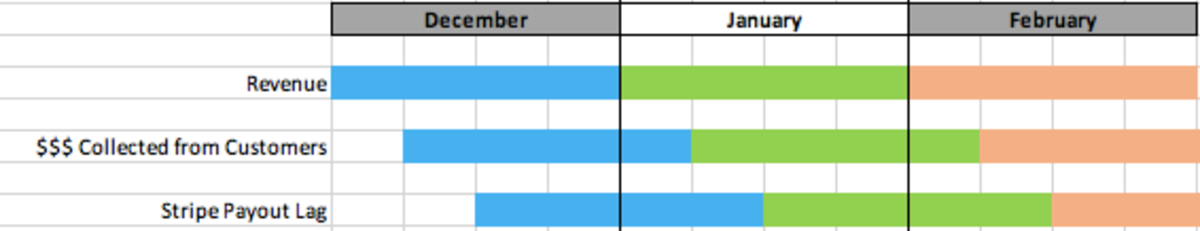

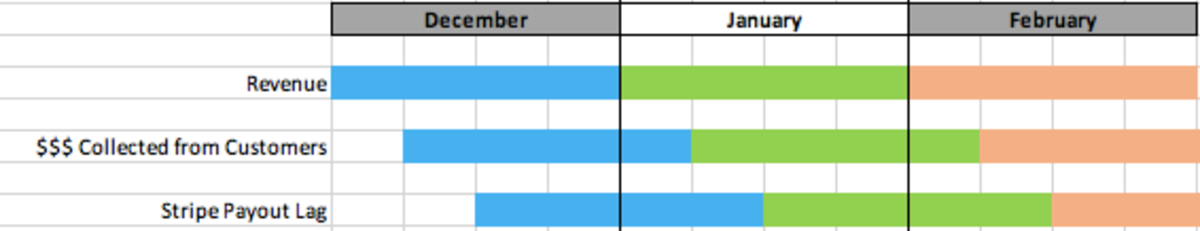

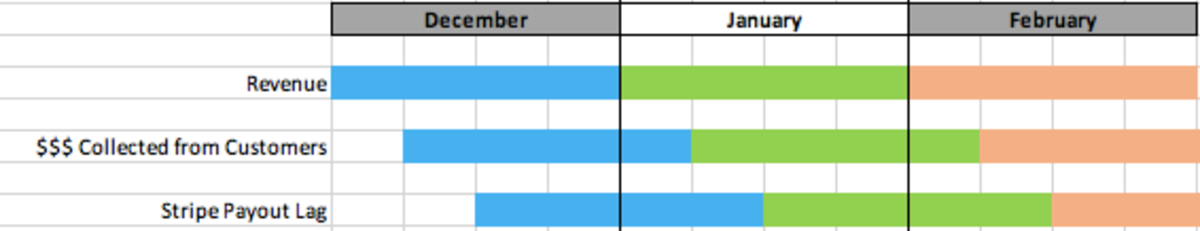

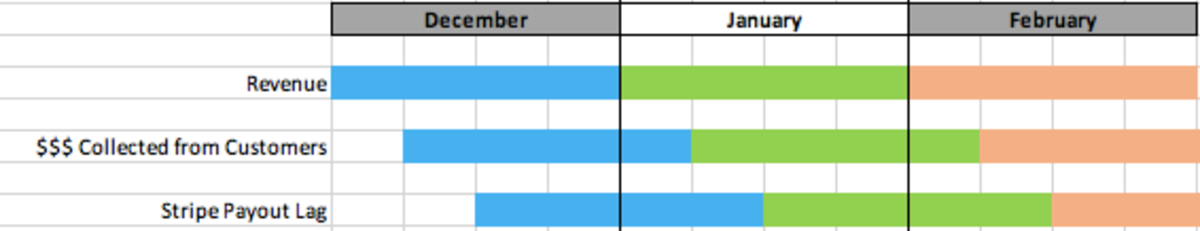

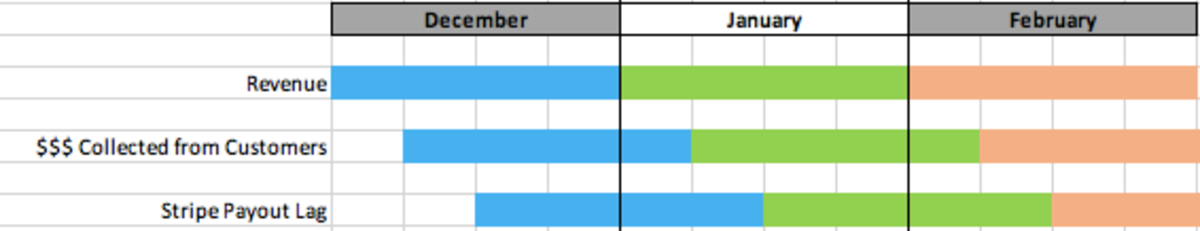

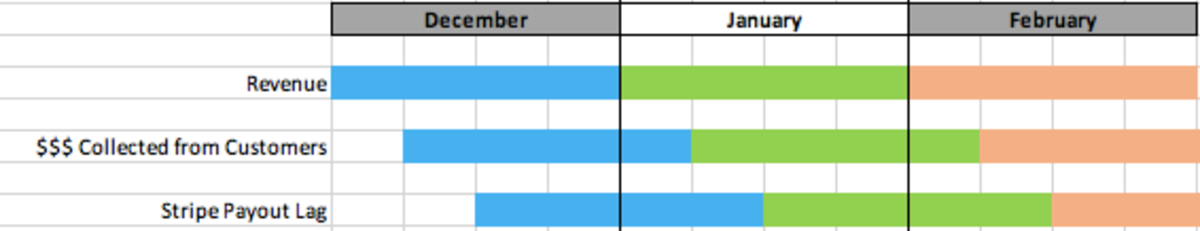

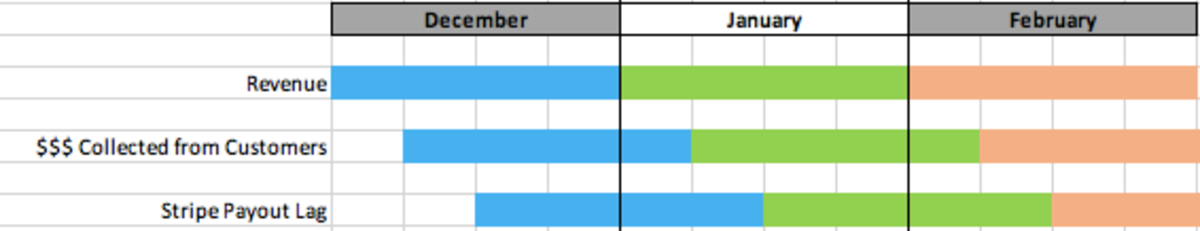

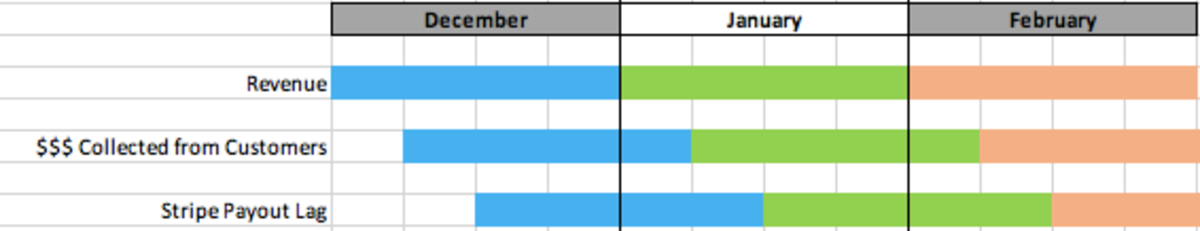

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

It's important to mention that the amounts in the righthand column will likely never match up with the final deposit amount. This is because the final deposits amount is taken directly from Stripe - if there is, or has been, anything in your Stripe not associated with Proximity the numbers will not add up.

-

Updated by allison blevins, Jul 08, 2023 at 6:38pm

APPLIES TO: Coworking, Workplace

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

It's important to mention that the amounts in the righthand column will likely never match up with the final deposit amount. This is because the final deposits amount is taken directly from Stripe - if there is, or has been, anything in your Stripe not associated with Proximity the numbers will not add up.

-

Updated by Megan Pastor, Jun 27, 2023 at 12:12pm

Reports,deposit reconciliation,net revenue,adjusted grossrevenuerevenue,payment -

Updated by Megan Pastor, Jun 27, 2023 at 12:12pm

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

It's important to mention that the amounts in the righthand column will likely never match up with the final deposit amount. This is because the final deposits amount is taken directly from Stripe - if there is, or has been, anything in your Stripe not associated with Proximity the numbers will not add up.

More on how payment processing works.

AB 11.8.22 -

Updated by Amy Babuka, Nov 08, 2022 at 8:04am

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

It's important to mention that the amounts in the righthand column will likely never match up with the final deposit amount. This is because the final deposits amount is taken directly from Stripe - if there is, or has been, anything in your Stripe not associated with Proximity the numbers will not add up.

More on how payment processing works.

ER 3.9.21AB 11.8.22 -

Updated by Emma Reimer, Jun 22, 2021 at 10:49am

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

More on how payment processing works.

ER 3.9.21

-

Updated by Emma Reimer, May 05, 2021 at 8:48am

Reports,deposit reconciliation,net revenue,adjusted gross revenue -

Updated by Emma Reimer, May 05, 2021 at 8:48am

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

More on how payment processing works.

ER 3.9.21

Keyword, phrases, platform function:Reports, deposit reconciliation, net revenue, adjusted gross revenue -

Updated by Emma Reimer, Mar 09, 2021 at 1:33pm

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.More on how payment processing works.

ER 3.9.21

Keyword, phrases, platform function:

Reports, deposit reconciliation, net revenue, adjusted gross revenue -

Updated by Emma Reimer, Mar 09, 2021 at 12:21pm

Navigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

More on how payment processing works.

ER 3.9.21

Keyword, phrases, platform function:

Reports, deposit reconciliation, net revenue, adjusted gross revenue -

Updated by Emma Reimer, Mar 09, 2021 at 12:19pm

Deposit Reconciliation -

Updated by Emma Reimer, Mar 09, 2021 at 12:19pm

Deposit ReconciliationNavigate to Reports > Reconciliation.

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

-

Created by Emma Reimer, Mar 09, 2021 at 12:15pm