Handling Payment Disputes

This document applies to: Coworking & Workplace

Disputes occur when a member requests that their bank reverse a charge. There are a number of different reasons account holders can give the bank as to why they are disputing the charge, including suspected fraud or being denied a membership cancellation. Oftentimes, these reasons are different than what you might expect and are based on a member’s limited understanding of the dispute process. Don’t take it personally.

Take the time to review every dispute, and, if possible, work with the member to address it. We suggest having the member call their bank to withdraw the dispute if it was made in error. You may submit information and evidence that demonstrate the validity of the charge, which will be reported to the bank and aid them in their dispute. You may also accept the dispute as valid, which will immediately close the dispute and return funds to the member.

Please note that Proximity does not have any say or influence in the outcome of a dispute. All decisions are made by the bank and are final. It is not possible to appeal a decision.

Stripe (our third-party credit card processor) limits the document upload size to 5 MB for all files.

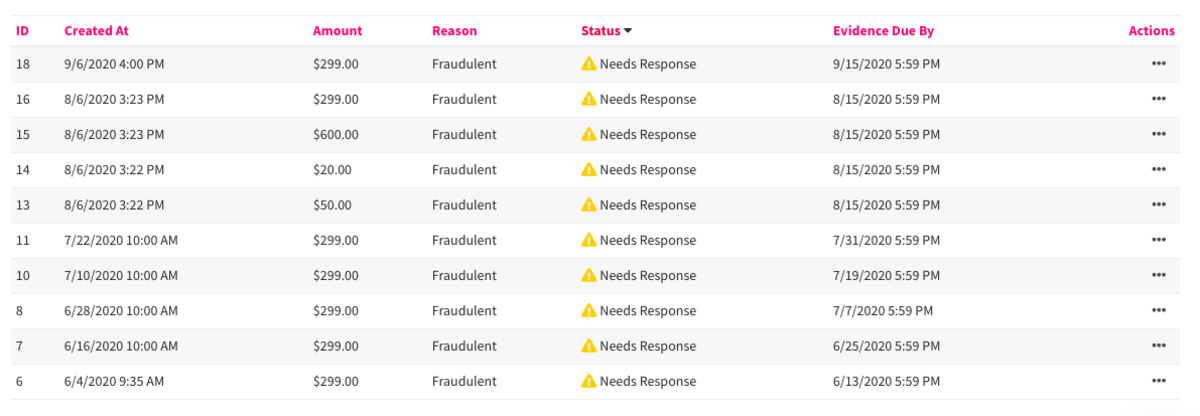

On the Disputes tab, you'll see when the dispute was created, the amount, the reason for the dispute, the status, and the evidence due date.

Status:

- Needs Response: Evidence still needs to be submitted.

- Under Review: Evidence has been submitted. The dispute is in review. It takes the bank anywhere between 60-75 days to review the dispute.

- Won

- Lost: Please note: all decisions made by the bank are final, no appeals will be granted.

Submitting Evidence

From the Action column, hover over the three dots on the right side of the dispute and select Manage Evidence. (You can also choose to Accept the dispute or View Invoice.)

- You'll want to fill out all of the fields to the best of your ability. The more information the bank has the better. In the fields Customer Signature, Customer Communication, and Receipt, you will need to upload either a PDF or image file (jpeg, png.)

- You'll need to choose the type of service that was provided: Digital Product/Service, Physical Product/Service, or Offline Service.

- Then you'll need to upload any additional evidence you may have and your statement.

- To SAVE your progress and come back to it later, select Save Progress.

- To SUBMIT your evidence to the bank, select Submit Evidence. Note: this can only be done once. Make sure you are ready to submit the evidence before selecting Submit Evidence. Once the evidence is submitted, the Status will change to Under Review.

Please Note: ACH Disputes are lost right away. In rare situations, Stripe might receive an ACH failure from the bank after a payment has succeeded. If this happens, Stripe creates a dispute. Here is more information on ACH disputes from Stripe. Proximity does not have any say or influence in the outcome of a dispute. All decisions are made by the bank and are final. It is not possible to appeal a decision.