Deposit Reconciliation

This document applies to: Coworking & Workplace

Using this report, you'll be able to see your gross revenue from the current period, adjusted gross revenue, net revenue, and then the total deposits from the current period.

Navigate to Reports > Reconciliation.

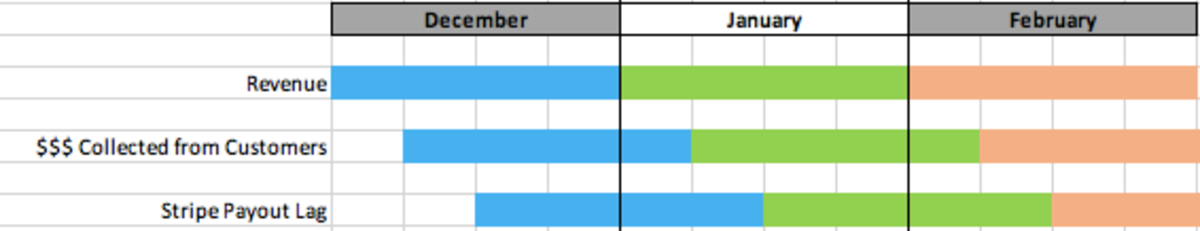

Because accrual accounting records revenue when a customer is invoiced, all of the revenue for a given period may not actually be collected until a later period. This creates a timing difference. There are often other adjustments that can increase or decrease the amount that ultimately gets deposited.

The issue is that you see X dollars of revenue for a period, but Y dollars is what was deposited into your bank account. You have revenue for January, and you have deposits for January, and this report explains why they are different.

There are two components to this report. The first is the timing difference component. Revenue is recorded. Then it’s collected. Then it’s deposited. Often this spans accounting periods.

The second component to this report is adjustments. There can be numerous adjustments, usually reductions, but not always - (i.e winning a dispute would be an add-back.)

Adjustments included in this report:

- Refunds

- Credits

- Offline payments

- Credit memos

- Disputes

- Processing Fees

It's important to mention that the amounts in the righthand column will likely never match up with the final deposit amount. This is because the final deposits amount is taken directly from Stripe - if there is, or has been, anything in your Stripe not associated with Proximity the numbers will not add up.